Previously a sell, the recent big drop in crude has made Big Oil a buy. How to position to profit from continued consolidation in XOM stock.

shutterstock.com – StockNews

A little over a month ago, I wrote about why I thought oil and oil stocks were a short in “5 Reasons Why It’s Finally The Time To Sell Big Oil”. The fundamentals, technicals, and implied volatility were all getting to extremes. Probabilities favored a pullback.

Now that oil and oils stocks have fallen over 15% in the past 30 days, my opinion has changed as well. Price does matter. My prior bearish outlook has turned to a more neutral to slightly bullish viewpoint. Let’s look at three reasons why the worst may be over for the recent carnage in crude. Once again, I will be using ExxonMobil (XOM) as the poster child for Big Oil.

Fundamentals

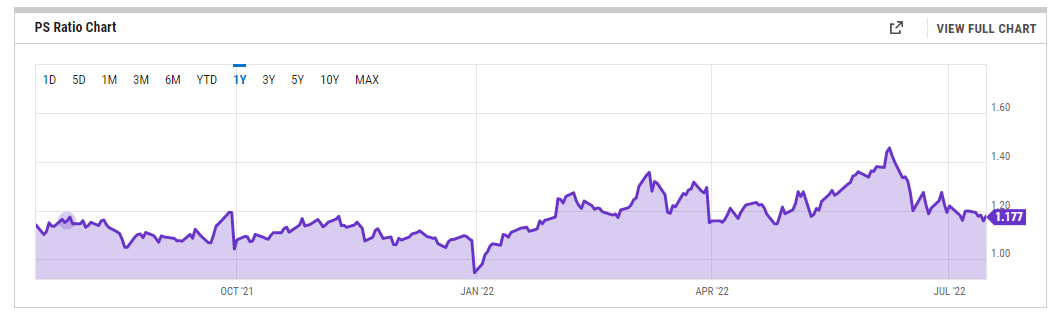

ExxonMobil stock was trading near historically rich valuations last month. P/S was over 1.4x back then and at by far the richest multiple of the prior 12 months. Now that XOM has cratered from the highs, valuations are much more attractive. Current P/S ratio stands at under 1.18x and nearing the lowest multiple in the past 5 months.

Other traditional fundamental metrics such as P/E and P/FCF show a similar drop. The current P/E stands at just over 14x and is at a discount to the 10-year average of 15.23X. Analysts are expecting ExxonMobil to benefit greatly from the increased refining margins and upped the FY 2022 earnings estimates to over $11.50 per share. This equates to a forward P/E of under 8-which should begin to attract value investors.

Technicals

ExxonMobil reached oversold readings before finally bouncing. 9-day RSI breached 30 then turned higher. MACD hit a yearly lower before strengthening considerably. Bollinger Percent B went negative but has since returned to positive territory. XOM stock was trading at a big discount to the 20-day moving average. Shares bounced off major longer-term support at $82 once again.

Previous times all these indicators aligned in a similar fashion marked significant lows in ExxonMobil stock. The fact that it occurred at a major support level makes it an even more powerful indicator.

Implied Volatility

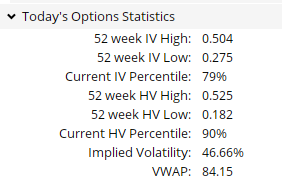

Last month XOM stock option prices were rather cheap. Implied volatility (IV) was trading at just the 34th percentile. The punishing pullback, however, has driven IV up sharply. Current IV now stands at the 79th percentile. This means options prices have gone from fairly cheap to pretty expensive-favoring option selling over option buying when constructing trades.

Spikes in IV are also many times a reliable bullish contrary indicator. Think about how big pops in the VIX have many times been a sign that the fear is at an extreme and the lows are right around the corner.

How To Trade It Now

A month ago, I recommended looking at buying puts on XOM as an effective way to position for a pullback. Shares were overvalued, overbought and IV was cheap. That trade would have worked out nicely given the subsequent big drop in ExxonMobil shares.

Now, however, ExxonMobil is looking way better from a valuation perspective. Shares are getting oversold. Option prices have gotten much more expensive. So instead of buying puts to position for a pullback, selling puts (or put spreads for lower risk traders) is the optimal way to cash in from continued consolidation around the major support area at $82.

Legendary trader Paul Tudor Jones has a saying: “Adapt, evolve, compete, or die”. In this market environment the ability to adapt to quickly changing market conditions and evolve your trading strategy is even more crucial.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

XOM shares closed at $84.54 on Friday, up $1.40 (+1.68%). Year-to-date, XOM has gained 41.12%, versus a -18.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

More…

The post 3 Reasons Why Big Oil Is A Buy After A Punishing Pullback appeared first on StockNews.com

Credit: Source link